While Enterprise Clients want AI/ML in their software products there is a conflict of interest with their vendors. Enterprise clients are worried about their competitive advantage getting equalized via the startup or the startup getting disproportionate benefit compared to the Enteprise Client. Early enterprise clients are the ones with the data and are also the hardest to convince. This was my experience at Artoo.

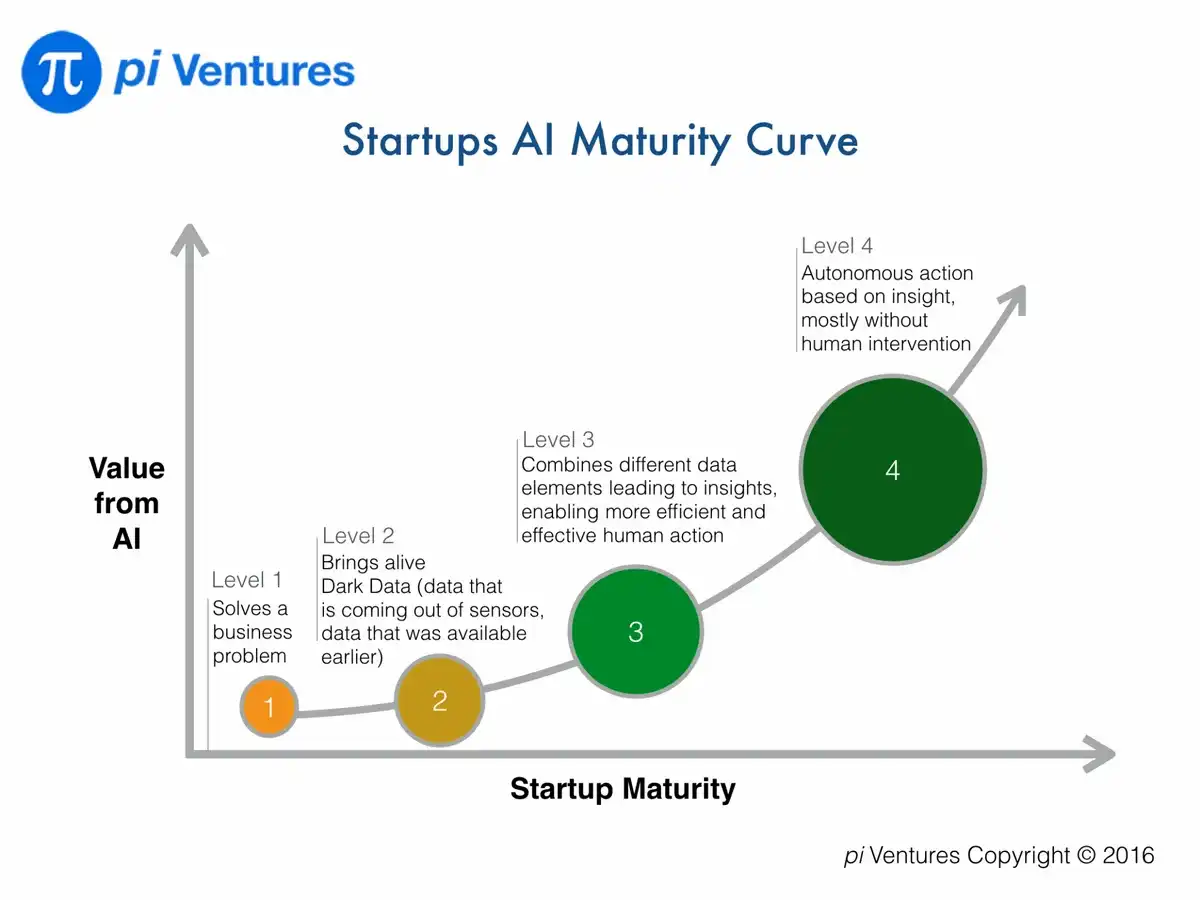

I found the following framework by Manish Singhal on AI Maturity Curve for Startups, very helpful. I feel there is a chasm between Level 1 and Level 2 where Enterprise SaaS companies especially struggle.

Level 1 is when you have paying customers and you have validated product-market fit. But you are solving the problem in the most direct way: mostly you have taken an existing process online. The Enterprise client is comfortable taking this leap of faith.

Level 2 is when you are able to improve the proposition a few fold by introducing something that the Enterprise client wasn’t doing. Here the startup needs to sell the dream to get access to the data.

Why the chasm between Level 1 and Level 2?

Enterprise SaaS companies get stuck in there ability to go from Level 1 to Level 2 because they need to rework (or pivot) on their existing contracts. To get the big clients you would have not only assigned data ownership to the client but also agreed to a very narrow data usage policy. (You do what you have to to close contracts!)

To get the change on the contract, you need to pitch sell the dream value proposition. There could be many different ideas. These ideas can be plotted on the following axes - risk and value.

Risk represents the risk in the Enterprise Client’s mind. It can also be a measure of how valuable they perceive this data to be.

Value is the strength of the value proposion.

In general there is a high correlation between value and risk ie high value proposition requires access to data that is perceived to be high risk.

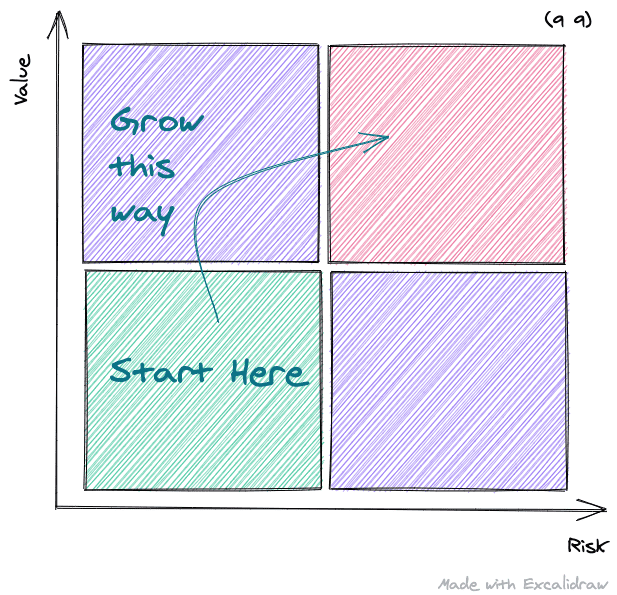

I made the mistake of pitching a (9,9) idea - high value but high risk. In the lending industry, a credit scoring model is the holy grail. The value was clear. But the risk was also clear:

- If other lenders use this algorithm then we wont have an advantage.

- Will Artoo gain more than us in sharing data?

The client didn’t say no directly. I spent an enormous amount of time to provide the regulatory and legal compliance. In the end I was not able to move a notch. And we remained a Level 1 company.

Build trust with “Low Risk” items first

I wish we had started in the Low Risk, Low Value quandrant. We could have developed trust and progressed much faster.

Once you see the High Value items, it’s hard to think of Low Value items. But they always exist. The simplest is the User Activity Data. Most Enterprise Clients are very concerned about their end customer data but not so much about their employee (or user) data.

You can build simple sales forecasting, gamficiation models to rework the contract and expand the data usage policy.

You can even try the new proposition with other clients before you come back to your early, anchor clients.

Doing a case study or published project where you give the client lime light. Do it on their behalf. Embrace services to understand where the value proposition lies.

Get a feel for the data. Develop your own intuition around it. As a founder or product manager, you should be able to direct the exploration - test your hunches.